The Chinese yuan is nearing global recognition. Barring a diplomatic shock, the International Monetary Fund looks set to add it to the basket of official reserve currencies later this month. Membership of the elite club will not prompt a rush to hold the renminbi – but it will help cement financial reform within China.

IMF staff - and Chief Executive Christine Lagarde - have concluded the yuan meets the fund’s criteria of being “freely usable”. Clearing this vague hurdle allows the IMF’s board to add the Chinese currency to the U.S. dollar, euro, British pound and Japanese yen when calculating the value of its Special Drawing Rights (SDR) from October next year.

Yet for all the fanfare, the yuan is far from international acceptance. Though it is important for trade with the People’s Republic, the currency barely features beyond China’s borders. It accounted for just 2.45 percent of global payments in September, according to SWIFT. It ranked ninth - behind the Mexican peso – in foreign exchange transactions when the Bank for International Settlements last measured foreign exchange transactions in 2013.

Joining the SDR may make other central banks more willing to add the yuan to their coffers. This could be significant: excluding China’s own pile, global foreign exchange reserves are about $7.8 trillion. Shifting, say, 10 percent of these into yuan over the next five years would require monetary authorities to spend about $150 billion a year on bonds and other assets denominated in renminbi.

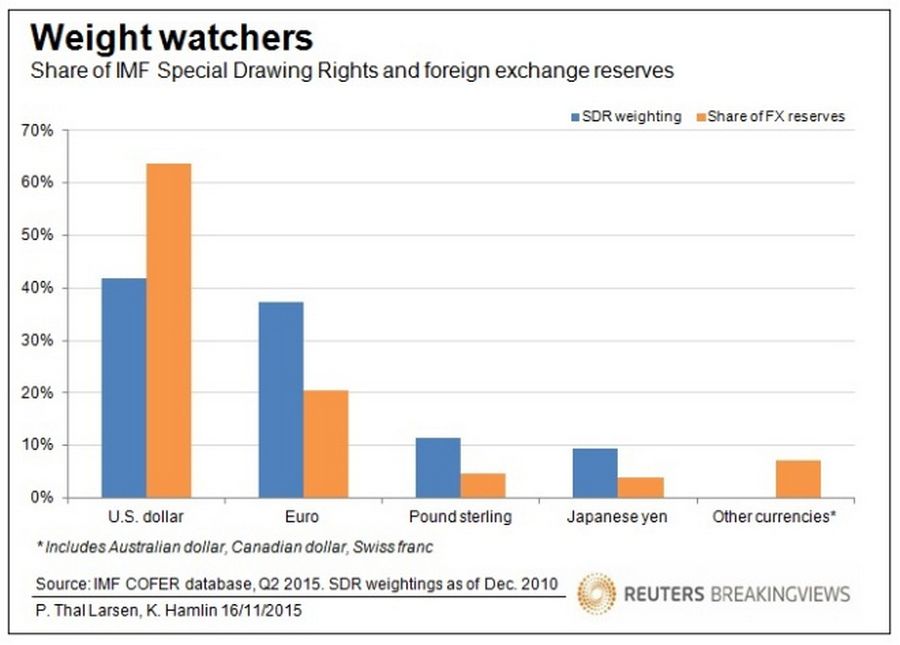

However, central banks don’t pay much attention to the IMF when dividing up their reserves. The yen has a 9.4 percent share of the SDR but less than 4 percent of reserve assets, according to IMF data.

The symbolic step is nonetheless a significant boost for Chinese financial reform. Central bank officials have used the promise of international recognition to overcome opposition to opening China’s capital account and liberalising its domestic financial system. Though those reforms are far from complete, joining the SDR makes them harder to reverse. The main benefit from admitting the yuan to the global currency club may be that China is more willing to play by international rules.