BTM inside the fence

One way to solve your power problems is to build the capacity yourself, inside your fence. It was a popular solution for industrial and chemical industries even during the days when the power grids were apparently fit for purpose. Now the grids have somewhat fallen behind what is required in the new energy market, it has become a pressing need – to source power to fuel the AI revolution.

Utilities and data centre developers are starting to come together as the power demands of DCs in the AI world mushroom and the grids struggle to cope.

Calpine is looking co-locate data centres onto its existing US generation sites. Iberdrola has announced a similar plan starting in Spain, a turnkey service for data centre companies on its sites – land, renewable electricity, security of supply, grid connection and energy contract.

CyrusOne and Kansai Electric Power have started construction of their first joint project in Japan, a 48MW IT scheme, with the joint venture planning 600MW IT within 10 years.

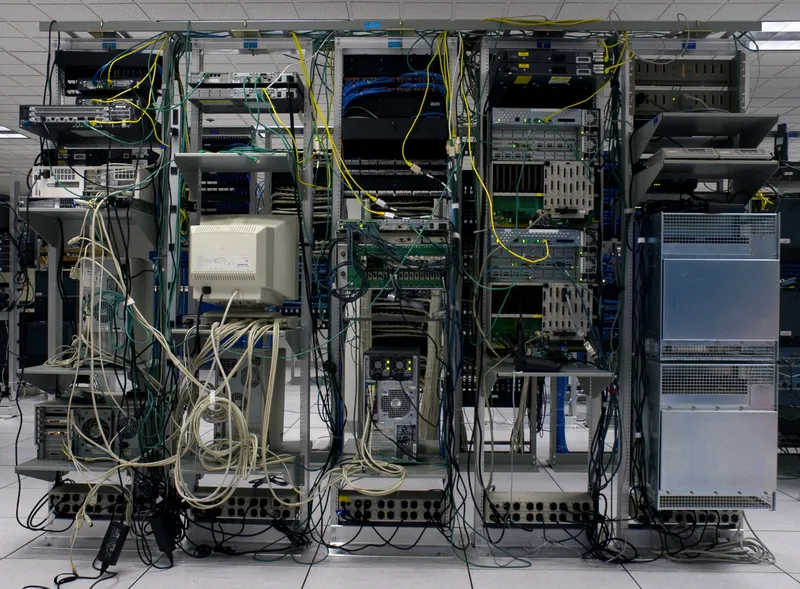

Inside the fence, or behind-the-meter, is a simple concept and has many advantages for larger users of power. The concept, however, quickly becomes complex, given its importance. A data centre without power for a few minutes or even a few seconds is in trouble.

Aramco is one company that has procured plenty of inside the fence power and steam plants with private developers for its Saudi projects. The negotiations with the developers and their financiers are always rigorous given the need for constant, reliable power.

Back in 2014 Aramco was granted US$310m in compensation on its Petrorabigh plant from its power and water supplier RAWEC owned by Marubeni, JGC, ACWA and Itochu due to blackouts.

Aluminium plants are particularly susceptible to power failure. In Qatar the Qatalum plant was hit by a five-hour power failure in 2010 leading to 444 of the production cells having to be cleaned out completely and delaying the ongoing construction programme by months.

Luckily the other 260 cells were not yet built. In 2017 Alba in Bahrain lost power for a day and and one of its five production lines was partially down for a few months.

So inside the fence power is no walk in the park and when things go wrong joint venture partnerships come under a lot of strain. For data centres the supply requirements are ever more pressing.

As ING data centre doyen Sicco Boomsma told PFI “a DC has a design and performance requirement that revolves around 6x9, which is 99.9999% uptime, 24/7/365 . . . So you need to create a requirement that has no faults whatsoever. The 6x9 model is the bare minimum, with many operators building to an 8x9 specification and agreeing contracts at 7x9 with hyperscalers."

For many developers securing power in-house has to be the option. Global data centre power demand is due to jump from 47GW to 71GW in three years. Building a transmission line takes decades so the developers need to go where the power is.

But there could be a flip side on the coin. Data centres are big customers for the utilities. They could even provide power to become a solution for times when the grid itself is stressed.

Jonathan Winer, CEO and co-founder of Sidewalk Infrastructure Partners in the US told the tech media its Verrus data centres "are designed to use their onsite battery storage capacity to island from the grid during those times, batching the more flexible AI compute needs, and keeping power up for cloud computing halls."

“We’re utilising the power more efficiently,” Winer said. “We’re essentially spinning up compute when we need it compared to the power, and we’re helping the load factor of the utility itself, because we’re basically a battery on the grid, rather than merely a consumer of power.”

A battery on the grid. Oh! “In order to add what we’re going to need both of the AI challenge and just general cloud compute there’s going to have to be a new approach to energy management,” Winer said. Simply building more data centres, whether run by third-party data centre operators or by the hyperscalers themselves, will not keep up with demand, he said. It is part of the move from data centres being a real estate play to a centre stage of the wider economy.

That presumably is the idea behind the joint venture between BlackRock. Global Infrastructure Partners, Microsoft and Abu Dhabi investor MGX to invest in data centres and the supporting power infrastructure.

Apparently US$30bn will be initially invested moving up to US$100bn eventually. GIP chairman and CEO Bayo Ogunlesi, who knows a bit about financing power projects, said "there is a clear need to mobilise significant amounts of private capital to fund investments in essential infrastructure. One manifestation of this is the capital required to support the development of AI".

This partnership will support an open architecture and broad ecosystem, providing full access on a non-exclusive basis for a diverse range of partners and companies. PPA anyone?