Meters get smart in India

India's smart metering market holds immense promise for transforming the power sector, improving operational efficiencies, and enhancing consumer experiences. With government support and robust payment mechanisms in place, smart metering projects are poised to drive sustainable growth and usher in a new era of power distribution in the country. By leveraging smart metering technology, India can pave the way for a more resilient, efficient, and sustainable energy future. ByAbhishek Verma, senior vice-president, project advisory and structured finance group andMrinal Kher, vice-president project advisory and structured finance group,SBICAPS.

India's power sector, characterised by its sheer size and complexity, has undergone major reforms in the past few years, including in the power distribution segment. India’s power distribution companies (discoms), which are mostly state-owned, had accumulated losses amounting to Rs5,49,491 crores (US$66.2bn) up to March 31 2022. While numerous reform efforts have yielded some positive results, innovative solutions are required to revitalise the sector.

In this context, the Government of India (GoI) has launched several schemes aimed at upgrading distribution infrastructure and bolstering discoms' financial health. Notably, the revamped distribution sector scheme (RDSS), signifies a monumental shift towards modernisation and financial sustainability. With an outlay of Rs3.03 lakh crores (US$36.5bn), the RDSS initiative aims to reduce the aggregate technical and commercial (AT&C) losses of discoms from 16.42% in fiscal year 2022 to 12%–15% by fiscal year 2025 and modernise the distribution networks.

Smart metering under RDSS

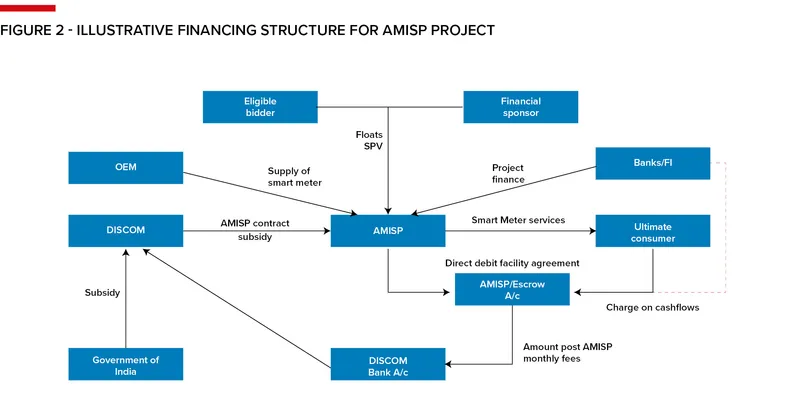

A pivotal component of RDSS is the implementation of smart metering systems under the innovative design-build-finance-own-operate-transfer (DBFOOT) model. PFC and REC have been designated as nodal agencies for the RDSS scheme.

As per the model advanced metering infrastructure service providers (AMISP) contract, AMISPs are tasked with financing, supplying, installing, and operating smart meters, alongside communication and IT infrastructure. This model empowers discoms to deploy smart meters without upfront investments. The discoms also gain from reduced losses and improved billing efficiency. According to CareEdge Ratings estimates, AMISPs are likely to provide additional cumulative revenue potential of about Rs4.5 lakh crore in the next seven years, ie FY 2024–2031 to the discoms.

Smart meter projects are being awarded to AMISPs through the bidding route, with the key bidding parameter being the service charge per month per meter. The salient features of AMISP contracts are:

* Scope – Implementation of advanced metering infrastructure – supply, installation, integration, testing, and commissioning of the smart metering system, communication infrastructure including head end system (HES), meter data management system (MDM), mobile application, network operation cum monitoring centre (NOMC), along with necessary hardware and software, AMI system integration, consumer indexing with distribution transformer (DT) meters and feeder meter to DT – O&M and support services after the successful completion of the operational go-live of the system, training of discom personnel, etc.

* Contract period – Earlier of (a) 10 years from execution of AMISP contract or (b) expiry of total meter months of operating the AMI system after operational go-live. Total meter months are calculated as the total number of smart meters to be installed x 90 months1. Operational go-live is achieved when 5% of the total meters are installed.

* Lump-sum payment, government budgetary support (GBS) – Capped at Rs900 or 15% of smart metering cost, whichever is lower, Rs1,350 or 22.5% for notified special category states.

* AMISP service charge – The AMISP is entitled to bill monthly for operationalised meters after go-live during the contract period. AMISP raises invoices on discoms on a monthly basis at the rate quoted at the time of the bid, which is recovered via a direct debit facility (DDF) mechanism.

* Payment mechanism – Under the direct debit facility (DDF) mechanism, online payments made by consumers of a discom, through identified payment gateways, are pooled and deposited directly into the DDF, which will then be routed to AMISP’s bank account (TRA). Only post payment of entire monthly service charge from the DDF to the AMISP, will the funds flow to the discom. The discom has to ensure that at least five times the monthly service charges payable to the AMISP flow into the DDF account.

* Performance security – A bank guarantee (BG) of up to 10% of the contract value valid until 30 months from the execution of the contract will be discharged upon work completion, thereafter a BG of up to 5% of the contract value valid until six months beyond the end of contract is provided by the AMISP.

The AMISP generally starts the integration phase within three months of the execution date of the AMISP contract. The integration phase includes delivery, site installation and commissioning of NOMC with related hardware, software and equipment. The AMISP has to complete installation of feeder meters within nine months and achieve operational go-live by eight to 10 months from the date of contract. In the next 15–18 months, the AMISP is expected to complete the installation of the balance of smart meters.

Progress in installations

As of December 31 2023, the Ministry of Power (MoP) had approved GBS amounting to approximately Rs24,000 crores. Notable beneficiaries of GBS include discoms in Tamil Nadu, Uttar Pradesh, Maharashtra, Bihar, West Bengal, Gujarat, Rajasthan, and Madhya Pradesh. GBS disbursed up to November 2023 was less than Rs6,000 crores, highlighting the need for accelerated implementation.

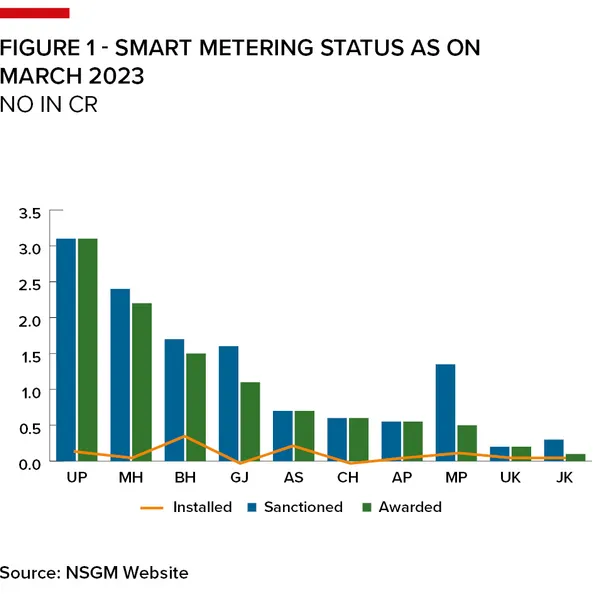

Out of 22.2 crore meters sanctioned as of March 2024, 10.9 crore meters have been awarded, with installations of approximately 1 crore units.

Key entrants

The smart metering market is poised for rapid growth in the next few years with strong interest evinced by both smart meter manufacturers, as well as pure-play power companies. Some of the larger smart metering contracts awarded so far include:

* IntelliSmart Infrastructure Private Ltd, a joint venture of the National Infrastructure and Investment Fund (IIFL) and Energy Efficiency Services Limited (EESL), which has won contracts in UP, Gujarat, Bihar, and Assam, with a total order value of Rs20,000 crores.

* Adani Energy Solutions Ltd, which has won contracts in Maharashtra, Bihar, Assam and Andhra Pradesh, with a total order value of Rs25,000 crores.

* Genus Power Infrastructure Ltd (GPIL), a smart meter manufacturer, has joined hands with GIC (Singapore) to create a platform, Gemstar Infra Pte Ltd, for bidding and implementation of AMISP contracts. The order value of AMISP contracts under the platform, including those to be transferred from GPIL, in Assam, Tamil Nadu, Gujarat, and Rajasthan is Rs16,200 crores.

* GMR Smart Electricity Distribution Private Ltd, which has received LoAs for smart metering projects in Uttar Pradesh, with an order value of Rs7,500 crores.

* Tata Power, which has received an LoA to implement a smart metering project in Chhattisgarh with an order value of Rs1,700 crores.

Project costs

In estimating the costs associated with an AMISP contract, several key components come into play. Typically, an AMISP project for 5,00,000 smart meters would cost Rs230 crores (US$27.7m) excluding GST. The cost of procurement of smart meter units will be a major cost contributor, which ranges between Rs3600 and Rs3700 per meter excluding GST on a blended basis for single-phase whole current meters, consumer meters, three-phase whole current meters and three- phase LT-CT meters, wherein single-phase meters constitute a maximum share of meters, 95%, to be installed along with few units of other meter types.

Meter installation charges typically range from Rs700 to Rs750 per meter. Meter installation includes cost towards head end system, meter data management system, system integration, RF communication, cloud services and 4G/5G network services.

Accordingly, the total hard cost of project per meter should be Rs4,400–Rs4,500 per meter excluding GST. Additional costs will be incurred towards soft cost – IDC and financing charges, etc – of Rs50–Rs70 per meter. Thus, the total project cost including soft costs and GST should be approximately Rs5,250–Rs5,400 per meter.

Financing structures

Given the strong revenue visibility under the AMISP contracts, coupled with the DDF mechanism, Indian lenders, both banks and NBFCs have demonstrated sufficient appetite for funding smart metering projects and are keen to fund reputed players entering the segment.

The typical financing structure for financing smart meter projects is as under:

* The cost of smart meter projects is partly funded by way of a one-time lump-sum payment upfront on the successful installation of a smart meter. As envisaged under the RDSS scheme, it is capped at Rs900/meter or 15% of the smart metering cost – Rs1350/meter or 22.5% for notified special category states – whichever is lower.

* The balance of costs is funded through a mix of debt-equity. The debt sizing is based on the appropriate debt service coverage ratio (DSCR) through the loan tenor. Debt financing is generally availed in rupee denominated term loans, with a door-to-door tenor of 8–8.5 years, with a suitable tail period of 15%, comprising an integration and installation period of two years, a moratorium of three to six months and repayment over 6–6.5 years.

* Part of the equity, 25%–30%, is infused upfront, and balance bought in as installation progresses, keeping the stipulated debt-equity levels. Promoter contributions may be in form of equity share capital or quasi equity through convertible instruments.

* A debt service reserve account (DSRA) ensuing 3–6 months interest and repayment obligations is required to be created/funded during the installation period.

* Security for lenders generally includes the following:

i) First charge over all the assets and cashflows, present and future, receivables, cash, and all accounts including escrow account, TRA account, DSRA.

ii) Assignment of AMISP contract, and other material project documents

iii) Pledge of equity shares and quasi-equity instruments of the sponsor, min. 51% to 100%.

iv) The AMISP contract should have rights for substitution of AMISP and termination payments in favour of lenders in case of event of default.

v) Establishment of DDF mechanisms prior to first disbursement is stipulated by lenders.

vi) The sponsor is required to provide a commitment regarding cost and time overrun. Further, the sponsor is required to inject additional equity to cover any delays in receipt of lump-sum payment from discoms and ensure sufficient funds are available for capex including any shortfall in revenues during the implementation period.

Key financing considerations

* Sponsor profile – The AMISP model contract provides that the sponsor bidding for the project has relevant project, technical and financial expertise. Further, lock-in requirements under the contract ensure that the sponsor continues to have significant role in the project. For a sole bidder AMISP, a minimum 51% shareholding is required throughout the contract and no change in shareholding is allowed for two years after work completion. In a consortium, no change in shareholding is permitted for two years post-completion and the lead member must maintain at least 51% ownership for two years post-completion and 26% thereafter.

* Revenue visibility – The AMISP is responsible for installation of smart meters along with associated infrastructure through a pre-paid mode within a span of 27 months from signing of the AMISP contract. Post operational go-live, the AMISP would continue to earn a monthly service charge for every meter installed for a span of total meter months. The fixed monthly charges ensure a steady stream of revenue, enhancing the AMISP's ability to meet debt service obligations.

* Direct debit facility – The DDF facility reduces the risks associated with the credit profile of discoms. While the payment security mechanism under DDF is very robust under the model AMISP contracts, the track record for such agreements is limited in India.

* Debt service coverage metrics – The AMISP model is characterised by a moderate leverage structure due to upfront construction support in the form of lump-sum payments. This, coupled with fixed monthly service charges, results in stable DSCR metrics. Lenders generally seek an average DSCR ~1.3x during loan tenor, with min. DSCR of ~1.1x in various sensitivity scenarios.

Key financing risks

* Revenue/cash flow risk – Cashflows are primarily derived from fixed monthly charges levied on consumers. These fixed payments offer a degree of predictability, mitigating the risk of revenue fluctuations.

The DDF mechanism is implemented to ensure a steady flow of payments. This mechanism aggregates payments not only from the area directly served by the AMISP but also from the entire supply area of the discom. Furthermore, the DDF mechanism mandates to maintain an average monthly inflow of at least five times the estimated monthly payment to the AMISP.

Moreover, the DDF mechanism ensures that consumer payments are promptly routed to the AMISP's bank account, enhancing liquidity, and reducing the risk of delayed payments. In the event of non-payment by the discom within 45 days of receiving an invoice, the discom is liable to pay interest. This serves as a deterrent against delayed payments, thereby mitigating the risk of cashflow disruptions and financial strain on the AMISP.

* Cost overrun/inflation risk – To address the risk of cost overrun or inflation, the sponsor is required to provide a commitment regarding cost and time overrun. In the event of delays in project implementation leading to increased costs, the sponsor undertakes to cover the additional expenses incurred. Furthermore, the sponsor may need to address any shortfalls resulting from delays in receiving lump-sum payments from the discom. To mitigate these risks, the sponsor may be required to inject additional equity to cover revenue shortfalls and ensure sufficient funds availability for capex.

* Risk of resistance by consumers – The discom is mandated to facilitate access to all locations required for smart meter deployment. Within six months of contract execution, the discom must provide necessary clearances for an initial 20% of the contiguous area for smart meter deployment. Additionally, within 18 months of contract execution, the discom is tasked with providing all clearances for the remaining contiguous area earmarked for smart meter deployment. By placing the responsibility on the discom to ensure timely access and regulatory compliance, this provision streamlines the deployment process.

* Damage to meters – In the event that a smart meter supplied and installed by the AMISP is damaged for reasons not attributable to the AMISP, the AMISP shall not be liable for such damage. In such cases, the AMISP shall repair or replace the meters and raise a supplementary invoice for the amount mutually agreed between the AMISP and the discom. This provision mitigates financial risk for the AMISP in cases where damage occurs due to external factors beyond their control.

* Termination of AMISP – In the event of default by either party – AMISP or discom – provisions for termination payments come into effect. Termination payments as stipulated under the AMISP contract may be required to be paid upon termination of the contract due to default. Such provisions serve to mitigate risks associated with contract performance.

References

1 – Model Contract for Appointment of AMISP for Smart Prepaid Metering in India on DBFOOT basis by Ministry of Power, Government of India: https://www.nsgm.gov.in/sites/default/files/AMISP-Contract-January-2021.pdf

2 – National Smart Grid Mission: All India Smart Metering Status: https://www.nsgm.gov.in/en/sm-stats-all

3 – Niti Aayog: https://www.niti.gov.in/sites/default/files/2021-08/Electricity-Distribution-Report_030821.pdf

5 – Care Edge Ratings: https://www.careratings.com/uploads/newsfiles/1711527284_Smart%20Meters_CareEdge%20Report.pdf

6 – ICRA: https://www.icra.in/CommonService/OpenMedia?Key=e26d0f4d-31fb-4a27-b835-c41a7e3865be

Footnote

1 – 90 months is considered the basis total contract period of 120 months less an installation period of 30 months. The installation period may vary in each contract.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email shahid.hamid@lseg.com in Asia Pacific & Middle East and leonie.welss@lseg.com for Europe & Americas.