HSBC’s decision not to leave London may have something to do with the United Kingdom going soft on banks since the election of a majority Conservative administration last May. The bigger question is whether there’s a grim logic to that softness.

Between the 2008 financial crisis and the 2015 election, the banking sector was a political bullseye – and for good reason. After UK taxpayers spent 65 billion pounds bailing out Royal Bank of Scotland and Lloyds Banking Group, there was regulatory and political mileage in preventing a repeat. Banks have paid billions of pounds in fines for mis-selling and conduct sins, and right up until May, politicians – including Chancellor George Osborne – seemed keen for them to pay more tax and hold more capital.

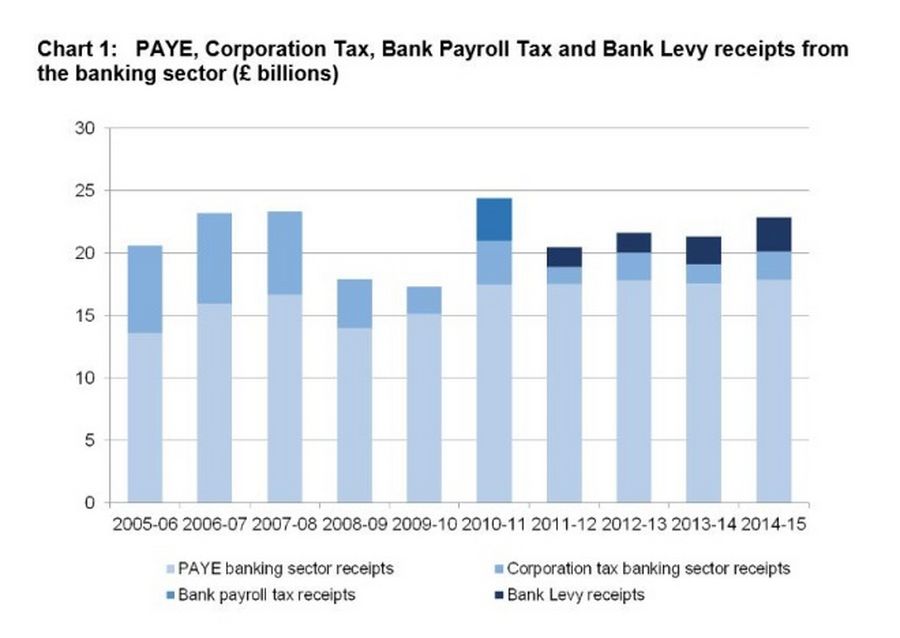

The subsequent easing in tone has been managed artfully. The UK’s levy on banks’ global balance sheets has been watered down to help sprawling lenders like HSBC that were previously taxed on global balance sheets. Yet banks’ corporation tax rates have risen. Removing the combative Martin Wheatley as head of the Financial Conduct Authority was made easier by internal organisational mis-steps. And the Bank of England’s call that banks on average finally have enough capital has some logic.

On some subjects the UK might be too soft. Academic John Vickers, who chaired a 2011 banking commission advocating UK banks’ retail arms be ring-fenced with 3 percent capital buffers, is spitting tacks that the actual level is 0.5 percent. The big risk is that the BoE has too much faith in global regulators to work together to safely wind down a bust bank. In time, the 2015 election may be seen as a watershed, and not in a good way.

Bankers still perform a very useful function: paying tax. They contributed 7.3 percent of all income taxes and 5.7 percent of corporation tax receipts in the tax year ending April 2015, according to HMRC figures. The view that a departed HSBC would lead to all 22.9 billion pounds of total UK tax following it out the door is clearly for the birds. But anyone seeking to rebalance the UK economy needs to have a good idea what replaces it.