The Fed has moved the goalposts again on raising interest rates. On Thursday Chair Janet Yellen and her colleagues kept overnight rates near zero, despite an improving U.S. economy and labor market. Meanwhile, non-existent levels of interest are inconsistent with history.

The latest rationale for standing pat seems to be “global economic and financial developments,” as the Federal Open Market Committee put it. That probably means slower economic growth in China and worldwide stock market wobbles over the summer.

Yet neither is directly the Fed’s problem. U.S. policymakers can’t ignore the rest of the world. But with unemployment steadily falling, by any of the domestic data the central bank claims to follow there was a clear case for starting on a gentle upward rate path this month.

Yellen’s only decent argument the other way is that inflation is quiescent. That’s true, but that would support keeping rates steady if they were already at a level appropriate to the status of the economy. As people like the New York Fed’s Bill Dudley have on occasion pointed out, zero is a post-crisis level that doesn’t suit a steadily improving environment. The Fed’s new forecasts even anticipate stronger growth this year, though not next, than was expected in June.

So zero doesn’t make sense. It’s instructive that in June 2004 the committee boosted rates for the first time after the 2001 recession by a quarter of a point to 1.25 percent. Its statement then described even the new, higher rate as still being “accommodative” and “providing ongoing support to economic activity.” Back in 1994, the Fed started post-recession tightening at 3.25 percent.

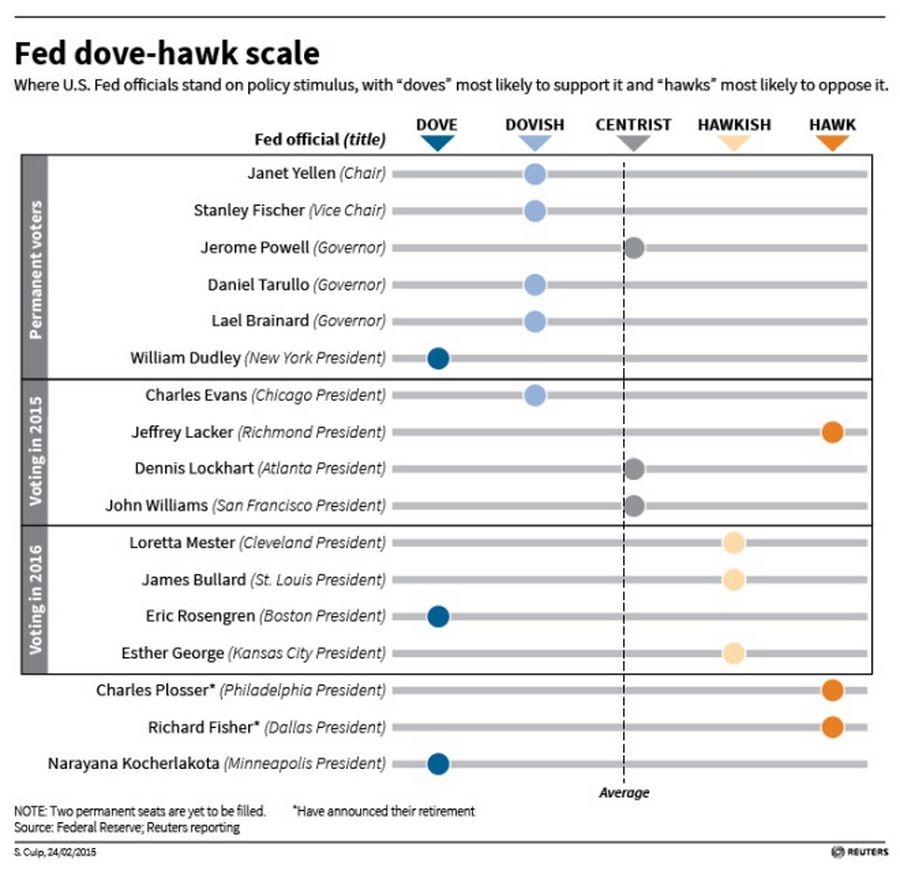

None of the current FOMC voters were part of the 2004 liftoff, though two did participate the last time rates went up at the end of a tightening period, in June 2006. One was Yellen; the other was Jeffrey Lacker, the hawkish Richmond Fed president who was the lone dissenter this week.

The Fed’s problem is that as the U.S. economy has strengthened, it has given the impression of finding new reasons not to raise rates. There’s a danger that its policymakers have started paying too much attention to financial markets and too little to the real economy. Lacker must be wondering what kind of perfection his colleagues are waiting for.

(This item has been corrected to read Thursday not Wednesday in the opening paragraph.)