China’s economic slowdown is exposing the debt debris in its banking sector. Dodgy credits on the balance sheets of the country’s four biggest lenders jumped by 28 percent to 592 billion yuan ($92.8 billion) in the first half of the year. Further deterioration would send earnings growth into reverse.

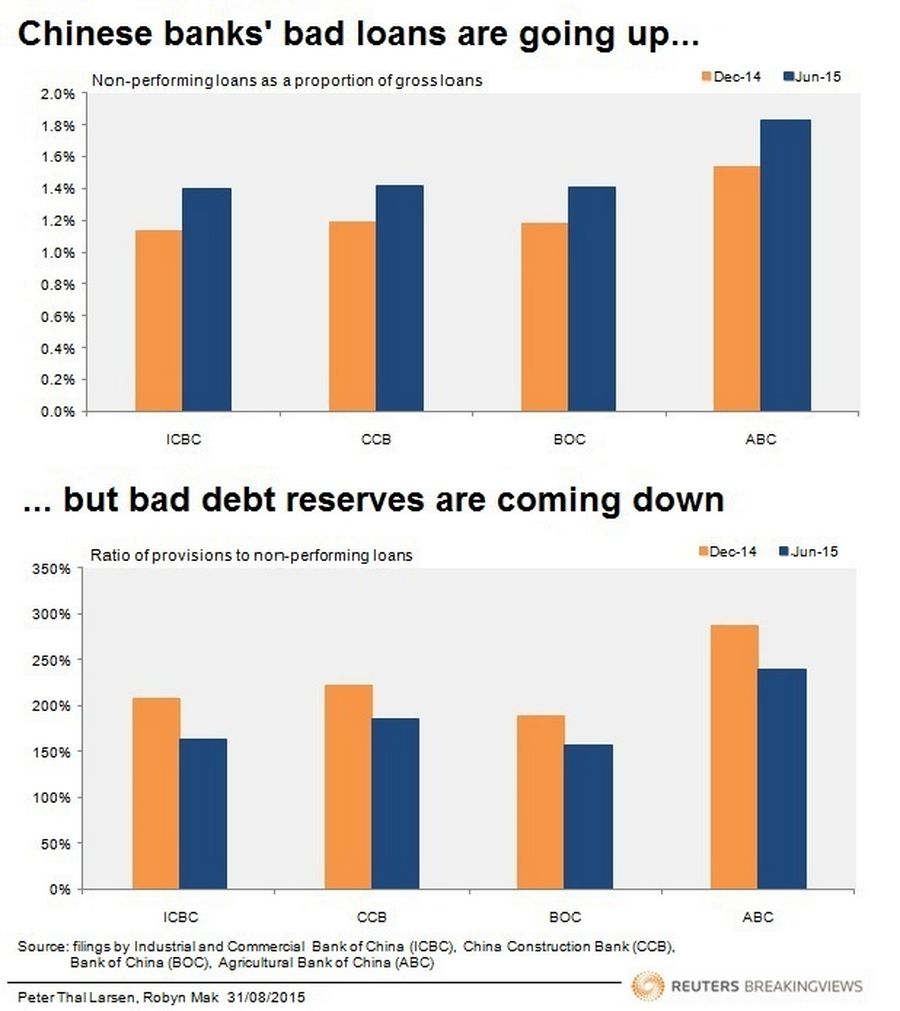

Bad debts are already eating into profitability. Increased provisions are the main reason why China’s big four banks reported little or no growth in pre-tax profit in the first half. Industrial and Commercial Bank of China, China Construction Bank, Bank of China now classify more than 1.4 percent of their loans as non-performing. Eighteen months ago, the ratio was around 1 percent. At Agricultural Bank of China the ratio jumped to 1.83 percent, from 1.2 percent at the end of 2013.

Turn over a few stones, however, and the situation looks more serious. Banks are topping up loan-loss reserves at a slower rate than new questionable credits are piling up. In the first half, total allowances for doubtful debts rose by 5 percent to 1.11 trillion yuan. As a result, the ratio of bad-debt reserves to soured loans has dropped below 200 percent for three of the four big banks. At Bank of China, the ratio at the end of June was 157 percent – close to the 150 percent minimum required by regulators.

It’s true that Chinese banks’ reported bad debt ratios are still relatively low, and reserves are higher than for many big international rivals. Regulators could allow lenders to tap into their stock of provisions – especially as the government effectively guarantees all big state-controlled banks.

Nevertheless, the mounting bad debt problem will weigh on earnings. If the four banks had topped up provisions to keep the ratio of reserves to bad debts stable, their first-half pre-tax profit would have fallen 30 percent or more.

Investors have been expecting this problem. Shares in the big four banks currently trade at around 90 percent of book value, according to Eikon. This reflects nervousness that they will be responsible for cleaning up the wreckage from China’s credit boom. Even so, before the latest results came out, the consensus among analysts was that pre-tax profit at the big four lenders would keep growing for the next few years. Barring a sudden economic revival, that now looks optimistic.