Beijing can bend the laws of economics, but it can’t break them. The central bank’s impressive foreign currency war chest gives China the room to muddle through between three objectives: lower interest rates, a stable yuan, and a reasonably open capital account. But reconciling what economists have dubbed the “impossible trinity” is beyond the grasp of even the People’s Republic.

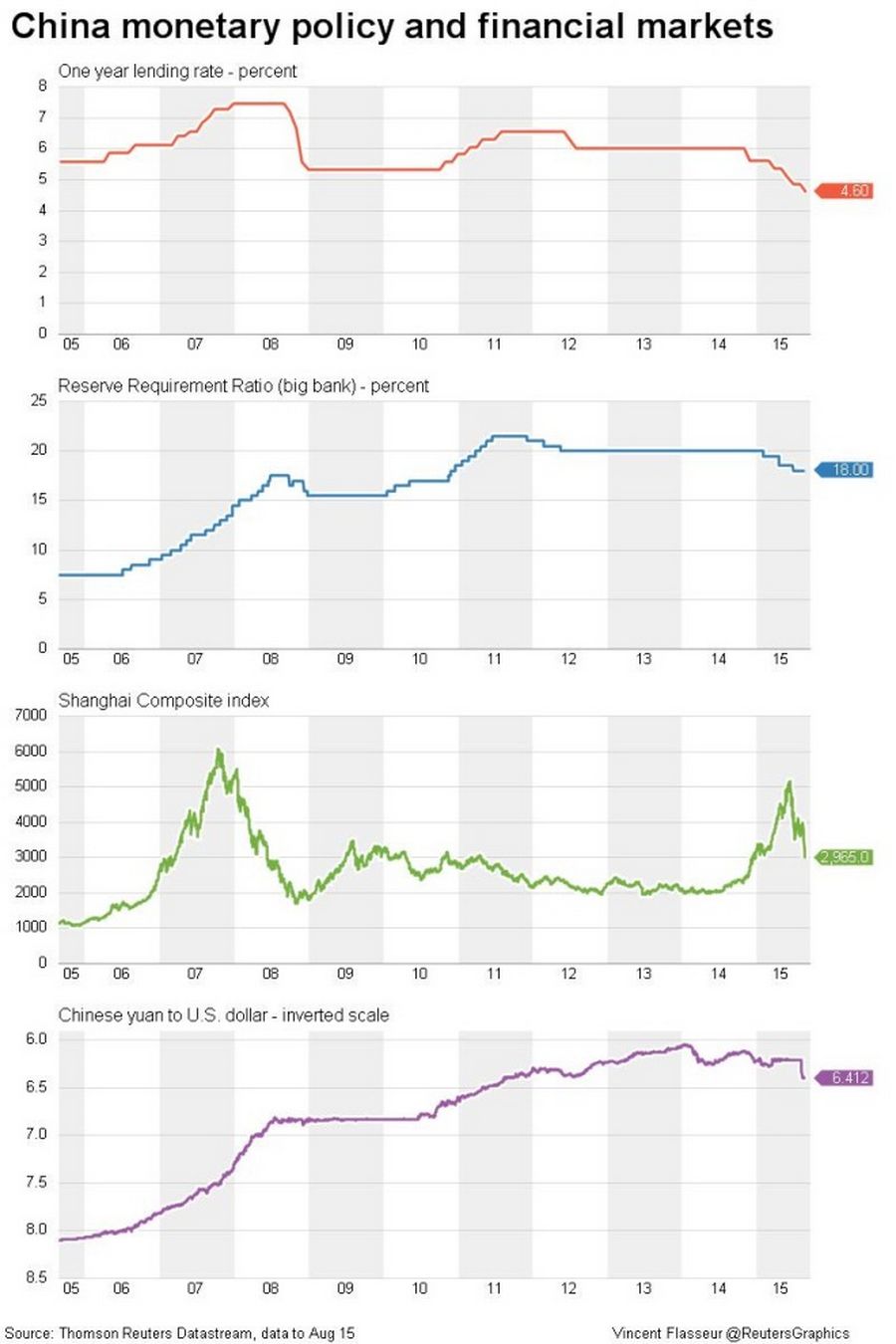

On Aug. 26, Chinese stock market investors seemed incapable of deciding whether the People’s Bank of China’s rate cut the previous evening was a pill or poison. The anxiety shows the tough road ahead. If investors conclude that lower mainland interest rates and more relaxed lending norms signal an increase in the money supply, they might take more capital out of China.

The “impossible trinity” theorises that countries cannot simultaneously control monetary policy and the exchange rate while letting capital flow freely. In practice, this gives China’s authorities very little choice. If they want to set interest rates lower and yet keep Premier Li Keqiang’s promise to keep the currency stable they will have to consider locking up capital. Macau police raids to prevent illegal cash leaks from the mainland suggest a renewed determination to restrict unauthorised cross-border flows. But any reversal of China’s gradual loosening of its capital account would undermine the country’s bid to add the yuan to the International Monetary Fund’s elite quasi-currency club this November.

A revival in economic growth might reverse the outflows. But the lackluster global economy, and the mainland’s twin problems of excess capacity and excessive debt, makes that hard to achieve. In the short term, China’s best hope may be that its economic woes continue to reverberate through world markets so that the Federal Reserve refrains from raising U.S. interest rates.

In the meantime, the only way Beijing can maintain the semblance of a stable currency against a resurgent U.S. dollar is to defend the yuan by selling down its reserves. That won’t help confidence either. At $3.65 trillion at the end of June, the kitty is sufficiently large to help China muddle through the impossible trinity for a while, but not large enough to reverse capital outflows if they become self-fulfilling.