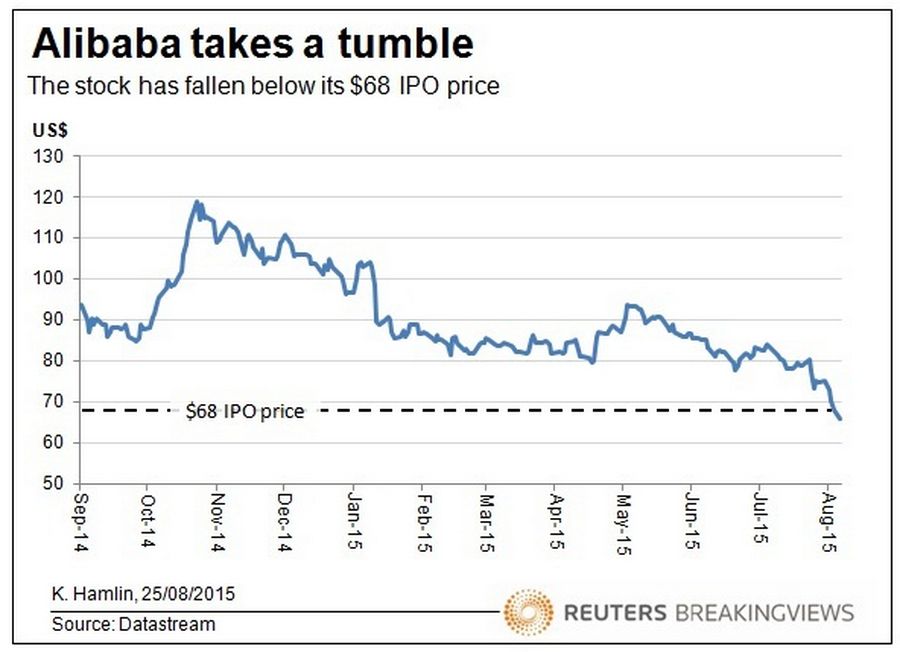

Alibaba stock still looks pricey despite the recent selloff. Less than a year after the Chinese web giant’s record $25 billion initial public offering, its shares have dropped below their $68 IPO price. Though macroeconomic worries have afflicted all Chinese companies, the group founded by Jack Ma is still highly valued when compared with rivals.

Shares in the New York-listed company hit $120 as recently as November. On Aug. 24 they closed at $65.8. Slumping Chinese stocks and worries about an economic slowdown are partly to blame. Bank of New York Mellon’s index of U.S.-listed Chinese stocks is down 16 percent since the beginning of the month.

Disappointing results have helped to wipe $100 billion from Alibaba’s market capitalisation since its peak. Revenue for the quarter ending June grew at its slowest rate in three years. Investors and employees whose shareholdings were locked up following the IPO will be free to sell next month, further weighing on the stock.

Even so, the $165 billion company hardly looks cheap. Start by stripping out investments such as its potential 33 percent shareholding in financial services affiliate Ant Financial. Based on Ant’s latest valuation reported by Reuters, that stake is worth $14.9 billion. Equity investments in companies like online video group Youku Tudou, social network Weibo and electronics retailer Suning add up to a further $12.9 billion. That implies investors value Alibaba’s core e-commerce business at about $138 billion.

Transactions on the company’s shopping platforms will hit $502 billion in the year to next March, reckons Barclays. Assume Alibaba’s “take rate” – the proportion of revenue it captures from advertising or commissions – remains stable at 2.5 percent. Applying last year’s operating margins and tax rate, Alibaba’s shopping sites will generate earnings of $4.5 billion, implying a valuation of more than 30 times earnings.

That’s significantly higher than Chinese web rivals. Tencent, which leads in gaming and social media, trades at 24 times forward earnings, while top search engine Baidu is on 20 times. Alibaba’s dominance of Chinese e-commerce means it deserves some kind of premium rating. But a return to its post-IPO euphoria looks unlikely.