Mysterious share movements are testing Hong Kong at a crucial point. Chinese solar company Hanergy’s valued soared to $40 billion in six months, then halved in a morning. Two other once-hot stocks have also suddenly plunged. The gyrations challenge Hong Kong’s claim to offer investors a transparent and orderly gateway to China.

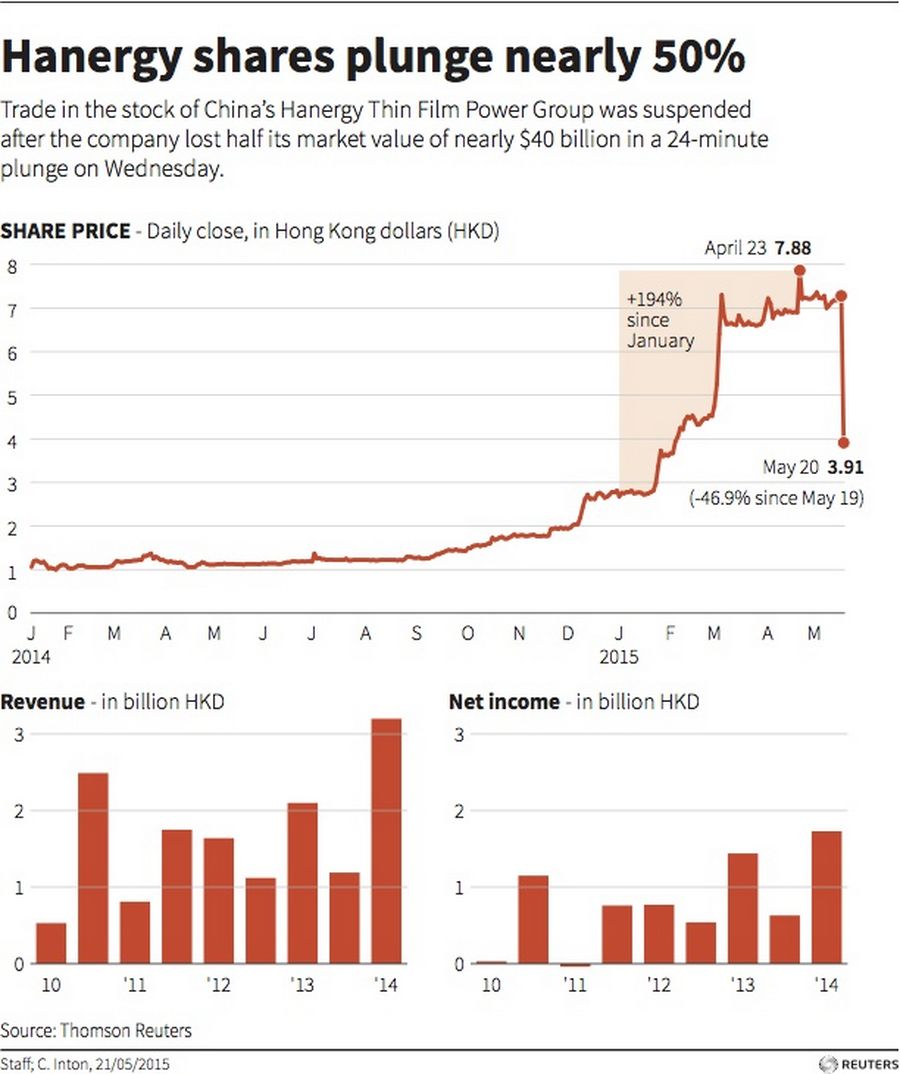

Hanergy Thin Film Power has bewildered investors for a while. The group’s technology is unproven and it earns most of its revenue from its unlisted Chinese parent. Nevertheless, the shares quadrupled in six months, by some measures making chairman Li Hejun China’s richest man.

The ascent ended on May 20, when the shares crashed before Hanergy requested their suspension. The sudden fall is as baffling as the rise. The Securities and Futures Commission is investigating alleged market manipulation, a source told Reuters.

Whatever the explanation, the loss of confidence has proved infectious. Shares in Goldin Financial and Goldin Properties, whose value had risen six-fold since the beginning of December, fell sharply on May 21. The companies, both controlled by polo-loving tycoon Pan Sutong, said they had no explanation for the collapse.

Hong Kong investors are no stranger to stock market hype, especially as mainland China’s renewed exuberance for equities has spread to the former British colony. Thin free floats also make shares more prone to gyrations: in March, the SFC warned that Pan and 19 other shareholders control all but 1.4 percent of Goldin Financial. Even so, such violent movements are unusual for companies this big. By market capitalisation, the sell-offs at Hanergy and Goldin Financial are the equivalent of Yahoo or American Airlines suddenly halving in value.

The episode comes at a critical moment. Hong Kong’s stock exchange operator has opened a link allowing foreign investors to buy shares in Shanghai, and a planned connection with Shenzhen is likely to go live soon. Yet to lure wary foreign investors, Hong Kong must show it can enforce values of openness and integrity. Hanergy’s rollercoaster ride suggests standards are slipping.