While Europe eases, China merely teases. The People’s Republic cut interest rates on May 10 for the third time in six months, responding to poor economic data and a corporate sector saddled with high debt. Making money cheaper is fine as it goes, but less dramatic than making it more abundant via quantitative easing. That can come later.

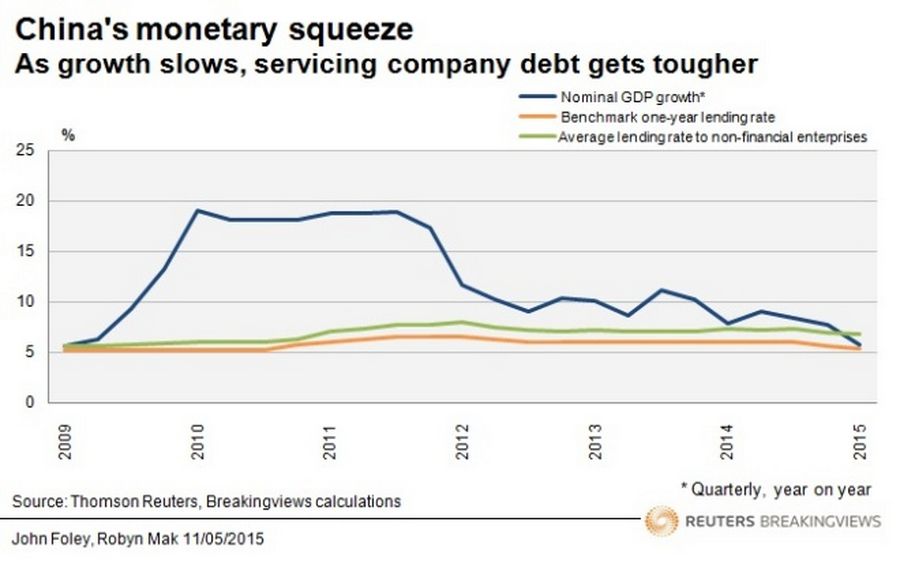

Cranking rates down helps existing borrowers with their interest payments. As a broad rule of thumb, if nominal GDP growth keeps pace with average loan rates, companies in aggregate should be able to service the debt they already have. Growth for the first quarter dropped below that level for the first time since 2009.

But tinkering with rates may not spur more borrowing when balance sheets are already stretched. Indeed, the debate in China has already moved on to quantitative easing – or hosing the slowing economy with new money. The central bank said on May 8 that such techniques weren’t needed. Even if they were, they could come in several forms. While Europe has set out on widespread money-printing, China has more subtle techniques, like freeing up lenders’ reserves locked up at the central bank. Commercial banks may eventually be allowed to use local government bonds, which don’t exist in large quantities yet, as collateral to get more funding. Those should boost lending, rather than just making what’s out there a shade cheaper.

Dramatically increasing the money supply isn’t a decision to take lightly, though. Inflation, which currently looks subdued, might speed up. So might frothy share prices. The yuan would likely depreciate. Moreover, China still hasn’t grasped the nettle on industrial overcapacity and a bloated state sector, so unleashing funds without strict conditions – which China’s financial sector is adept at circumventing – would see money go to the wrong places.

For now, the central bank’s strategy looks about right: ensure the market knows the means to pump money are there, and do no more. The teasing might just work. If not, China may have to use real easing to address its immediate problems, and in doing so create a slew of new ones.