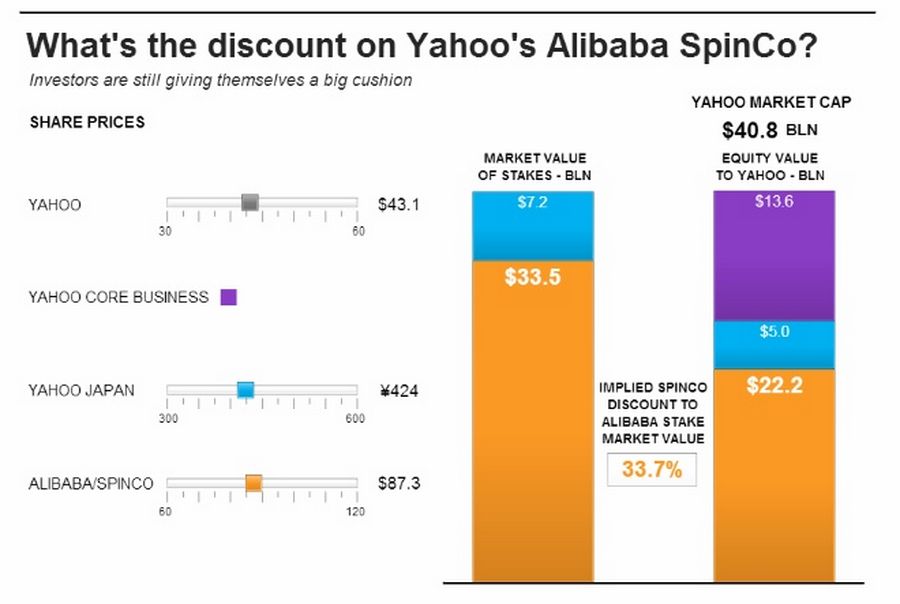

Yahoo can’t even earn a reward for doing what shareholders wanted. The company’s plan for a tax-free spinoff of its stake in Alibaba looks logical. But a Breakingviews calculator suggests investors are attaching a 34 percent discount to the U.S. tech firm’s Alibaba shares – assuming, that is, Yahoo’s core business is worth something.

What’s the discount on Yahoo’s Alibaba SpinCo?

Source: REUTERS/Richard Beales, Robert Cyran and Vincent Flasseur

The recent spinoff announcement came after years of investor pleas and internal Yahoo debates about how to unwind the $34 billion investment in the Chinese e-commerce giant without taking a tax hit. Yahoo, led by Chief Executive Marissa Mayer, finally said it will put the shares into a new investment company, SpinCo, along with its small business division, and distribute SpinCo’s stock to existing Yahoo shareholders.

Run the numbers, though, and Yahoo isn’t getting much credit. Analysts on average expect Mayer’s remaining businesses to throw off about $1.2 billion of EBITDA this year, according to Thomson Reuters. Split the difference between the enterprise value-to-EBITDA ratios of AOL and IAC/InterActive, and Yahoo’s core operations are worth $7.8 billion. Add back net cash, and the equity value works out at $13.6 billion.

Yahoo’s other Asian stake, its interest in Yahoo Japan, is worth a bit over $7 billion. As with Alibaba, realizing that could involve a tax hit to the tune of 30 percent or so. That makes the effective value around $5 billion.

The U.S. company’s market capitalization is around $41 billion. That means investors are attributing about $22 billion of worth to the future SpinCo, or more than a third less than the market value of Yahoo’s stake in Alibaba.

It’s to be expected that SpinCo will trade at a discount. For one thing, it will represent only an indirect interest in Alibaba. For another, the new vehicle will still face a tax bill if it ever sells shares in the Chinese firm, so that exposure is only deferred. And of course the spinoff hasn’t happened yet.

But that isn’t enough to explain such a large discount – or even the slightly narrower shortfall that results if Yahoo’s core business is given a more skeptical valuation. Yahoo’s shareholders could win both ways. Either the gap will narrow once SpinCo becomes a reality or, if it persists, Alibaba could eventually be tempted into what amounts to a cheap stock buyback.