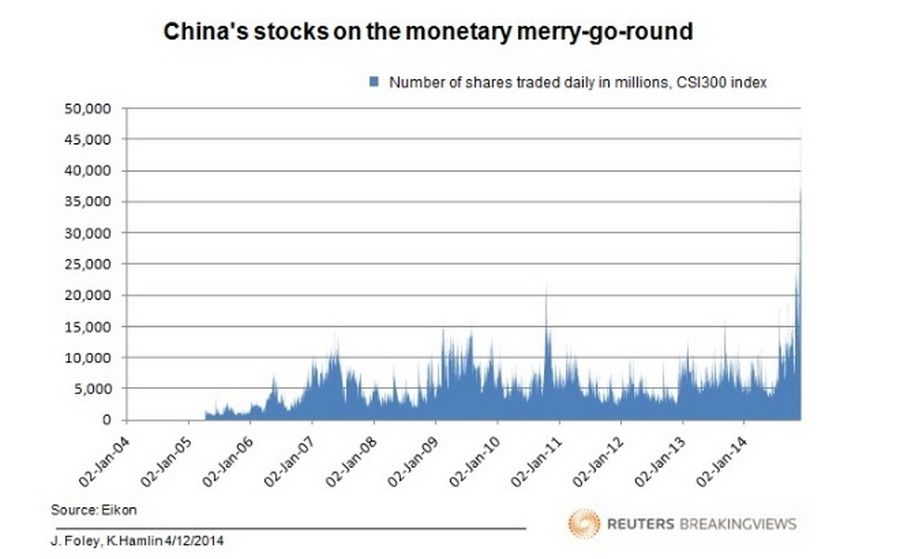

What’s in a Chinese share price? Text books say it should be a function of risk-free rates, equity risk premiums and expectations of company earnings. In reality, it’s money and hope. There’s no other explanation for the record trading volumes in the country’s markets on Dec. 3, and the astounding run-up in share prices that has preceded it.

The two major markets of Shanghai and Shenzhen saw a record 915 billion yuan ($149 billion) of shares trade on Dec. 3. The figure for the Shanghai bourse is twice the highest daily amount traded during 2009’s rush into stocks, while its benchmark index has risen by just over a third this year. And the enthusiasm is widespread: over a million new stock-trading accounts were opened in November.

Yet there’s little to justify the exuberance. Corporate results are looking dismal, especially as price increases and export growth slide. Industrial profits fell 2.1 percent in October from a year earlier, and the Purchasing Managers’ Indexes that give show how bosses of manufacturing companies feel about growth are weakening.

Inflows from Hong Kong, channeled through the new share-trading link, don’t explain it either. Money crossing the border might have pushed some mainland bank stocks closer to the price at which they trade in Hong Kong. But in most cases the premium Shanghai-listed stocks enjoy over their offshore equivalents has just widened.

Two things bring the picture into focus. The price of property, one of the few stores of value for Chinese investors, is falling. Headline declines of 1.6 percent over the past year sound modest, but sales have fallen every month this year. Meanwhile, rates available on savings are coming down too. What’s happening therefore looks like a monetary merry-go-round.

The worry is that the resulting stock market gains are particularly fragile. Property markets can shrug off a fall in share prices, but it’s unlikely that the reverse holds true. Plunging house prices would dent consumer confidence and hit shares in sectors from heavy materials to consumer goods. Sustainable wealth may not have been created by the bull run, but it could still be destroyed by what comes next.