A drop in Macau’s high rollers may push the Chinese territory’s gambling revenue to its first annual decline on record. Forecasts for next year seem over-optimistic. For many casinos in the coastal enclave, high-spending VIP gamblers are the biggest vulnerability. If they stop playing, the likes of Galaxy Entertainment and Wynn Macau would be particularly hard hit.

China’s millennia-long love of gambling is unlikely to abate in the long term, as Las Vegas Sands boss Sheldon Adelson reminded investors on Oct. 16. But short-term indicators are worrying. Macau’s VIP gaming revenue fell 19 percent for the three months ending September. In the whole of 2014, casinos’ take from gamblers may fall by 1 percent, Barclays estimates, and Macau’s new casino-floor smoking ban could worsen that decline.

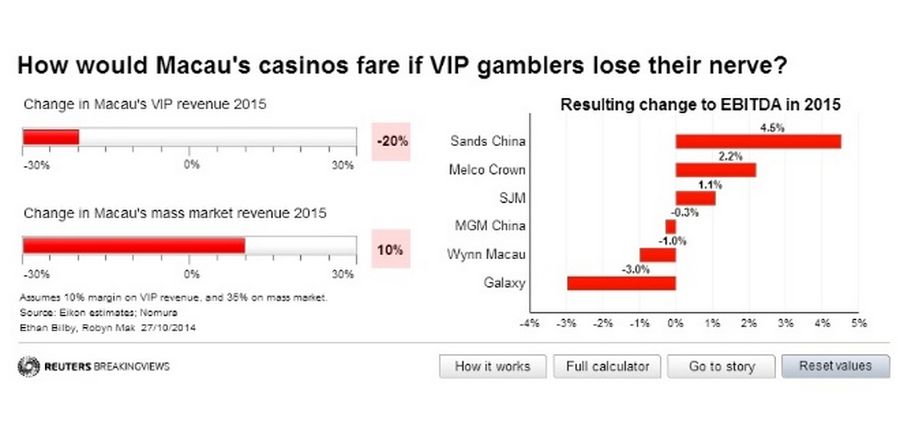

Revenue from the mass market, including that from slots, can make up for fewer VIPs in some cases. Such punters bring in less revenue, but are more profitable for casino operators. The EBITDA margin on VIP clients is around 10 percent, according to analysts at Kim Eng Securities; the margin on mass gamers is about 35 percent. Earnings can grow even if revenue does not.

Assume that next year, VIP revenue drops by 20 percent, while mass gaming revenue rises just 10 percent. Galaxy Entertainment, an operator that caters to high rollers, could see its EBITDA decline by up to 3 percent, according to Breakingviews calculations. Wynn Macau’s could slide by 1 percent. Those with greater mass exposure would still see EBITDA increase. Sands China could see growth of 4.5 percent.

Unless there is a let-up in China’s anti-graft campaign, which has made things particularly uncomfortable for high-spending gamblers, analysts may be too hopeful. They on average expect Galaxy’s EBITDA to rise 20 percent next year, for example, according to Eikon. That implies unlikely double-digit growth in revenue.

Of course, casinos can fight the fall-off. A spate of new openings starting next year may bring in new tourists. But staffing costs are rising, and Macau’s era of fast growth seems to have been left on the table. Either way, those who go for the mass market have the best chance of beating the odds.