If you cheapen it, they will come. China’s large real estate companies are going all-out to shift their properties, aided by recent reductions in mortgage rates and the relaxation of local restrictions on who can buy. When developers sell more for less, however, there is grief ahead.

China’s biggest homebuilders have been reporting positive sales even as the overall market has contracted 11 percent this year, according to official data. In big cities, sales in the week-long October holiday were almost back to last year’s level, according to data cited by Credit Suisse.

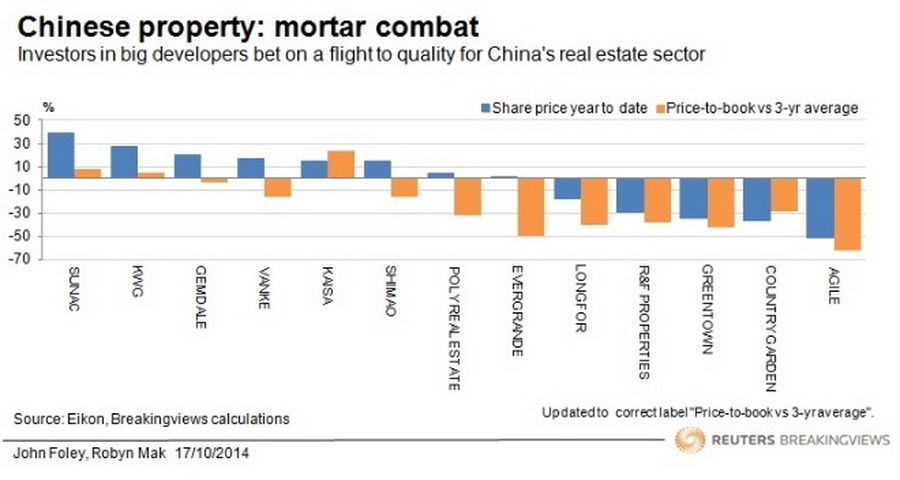

Investors buy the “flight to quality” theory. Overextended companies like Agile Property and R&F have been punished: their shares are down sharply this year. But the median share price of the forty biggest listed Chinese developers is up 15 percent. Their average price-to-book ratio of 1.4 is just below the three-year average of 1.6. The logic is seductive – their plots are better, and their houses more livable.

That judgment misses the big picture. Real estate companies report revenue and earnings based on completed units that they have handed over to buyers. But developers start taking payment when building has only just started. So published profit margins reflect deals that may have been struck two years ago. Even when companies report the value of contracted sales every month, investors can only guess at their eventual profitability.

This system creates a strong incentive for developers to promote short-term sales by cutting prices. Agile, whose chairman has been detained and which just launched a HK$1.7 billion rights issue, sold almost 40 percent more floor space in the first nine months of 2014 - but at a 20 percent lower price. This means that developers’ gross margins, which are typically around 30 percent, will shrink – even without factoring in the cost of one-off marketing promotions.

The good news is that cutting prices to shift properties gives people access to cheaper homes. The bad is that lower margins leave developers with less room to service debt and buy new land. That’s a big problem in the making. Forty out of 45 companies rated by Moody’s had a higher debt-to-equity ratio in June than last December. A pickup in sales may save developers’ face, but not their earnings.