China’s online money market funds deserve credit for offering savers the decent returns that banks cannot. But it is getting harder for the upstart industry to do so without piling on risk.

Online funds sprang up because of a simple arbitrage. Regulators cap bank deposit rates – the most consumers can get is 3.3 percent, for savings locked up for one year. But interbank rates, determined by supply and demand, are higher. Funds like Zeng Libao, an affiliate of e-commerce giant Alibaba, buy low-risk interbank assets and bonds and pass on the higher returns to retail customers. Money market products had 1.9 trillion yuan ($310 billion) under management in June, according to China’s securities regulator. Offerings from Alibaba and rivals Tencent, Netease, Baidu, Sina and Suning made up 38 percent of that.

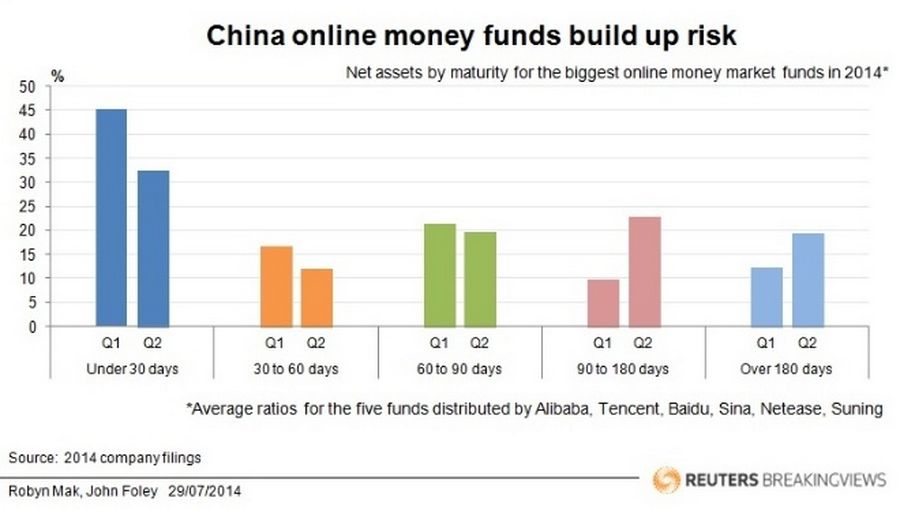

The rates that funds can muster are falling as competition becomes fiercer. The one-week repo rate, a benchmark for China’s interbank market, has more than halved from a high of nearly ten percent in December. Funds have responded by buying longer-dated assets, which tend to have higher yields. A third of Zeng Libao’s total investments, as a share of net assets, had maturities between 90 and 180 days at the end of June. The figure was just 3 percent in March.

Latecomers like the funds marketed by search engine Baidu and gaming group Tencent are reaching even further along the yield curve. Three of Zeng Libao’s four main online competitors have more than 20 percent of their net assets in paper dated over six months.

The problem is that money market funds let customers withdraw cash almost instantly. If customers ever demand their money back en masse, the funds would have to dump assets, which would depress prices, or restrict redemptions. Longer asset maturities increase that vulnerability. Fear could quickly spread to the rest of China’s financial system.

It’s not too late to head off that risk. One way is to regulate funds like banks, and make sure they have liquidity on hand to meet redemptions. Better yet, remove the arbitrage by liberalising bank deposit rates. If savers could get a decent return within the official banking system, they would be less tempted to fuel risk-taking outside it.