Xbox gamers fear the “red ring of death”, a flashing light that can herald system failure. Microsoft, which makes the consoles, must be awaiting a similar sign in China. After 22 years, the tech giant has achieved little in the country, which looks to account for around 2 percent of revenue. Cloud services may multiply that over time, but political headwinds are raising the cost of business - possibly too high.

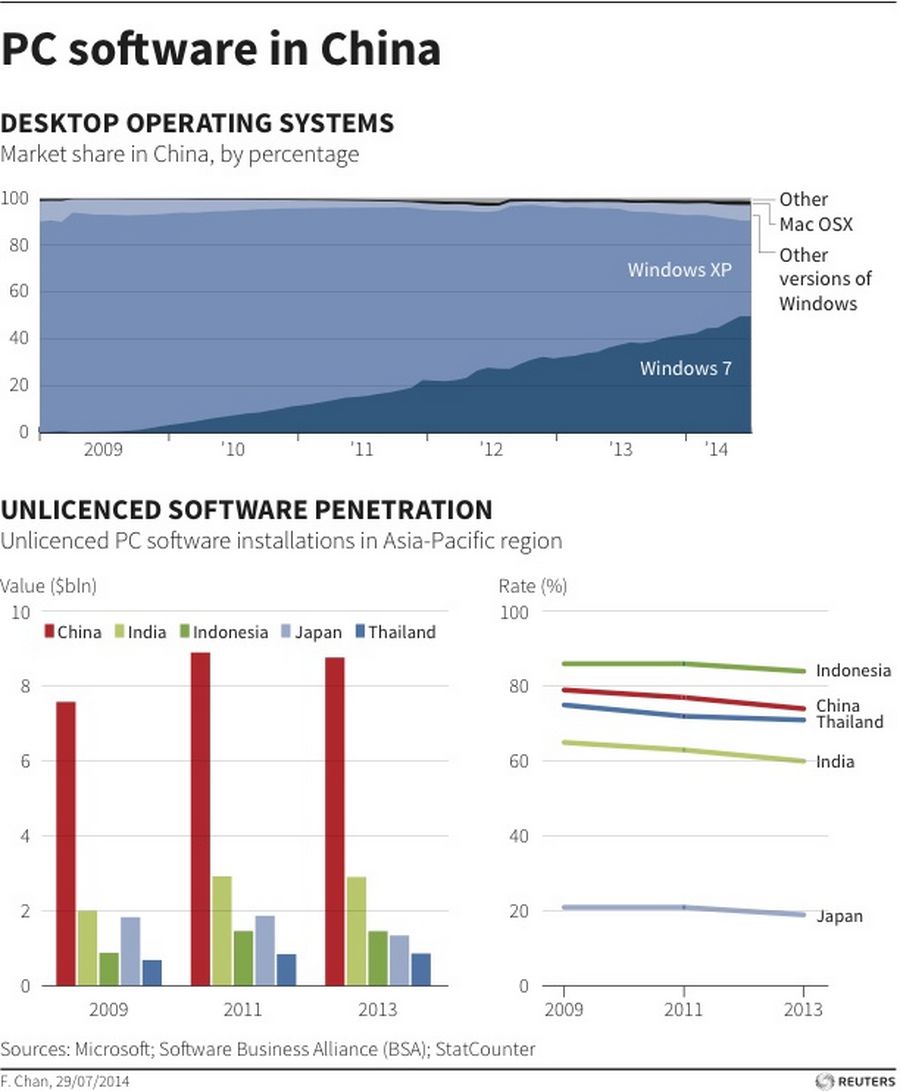

After years trying to persuade users to pay for its products, Microsoft is now fielding an antitrust probe by China’s State Administration for Industry and Commerce (SAIC), which said on July 29 it believes features in Microsoft Windows and Office violate local competition law. Yet there’s nothing to suggest the company enjoys the advantages that normally come with market dominance.

China sales for the year ending June 2013 surpassed $1 billion for the first time, Microsoft has said, but doesn’t give more detail than that. If those sales, which include servers, software and licencing from Windows-based smartphones, have grown at the same pace as Microsoft’s global business since, the figure might now be a little under $1.1 billion. Add on about $765 million in China revenue implied by Canalys shipment data for recently acquired Nokia, and the resulting $1.8 billion is just 2 percent of the $83 billion of global revenue Microsoft reported during the most recent calendar year.

That means China is mostly about option value. Revenue from cloud computing is the big hope. The group just launched its Azure platform of cloud-based programs and virtual servers. Just a quarter of that market this year would be worth $325 million in added Microsoft sales according to Forrester data. Yet it’s unlikely an American company will be able dominate such a security-sensitive market. Then there’s Xbox. China has just allowed sales of game consoles. But Chinese consumers may bristle over the high cost of a Chinese Xbox - 50 percent over the U.S. price.

The question is at what point China stops being worth it. Already, the potential costs are mounting. The regulators could fine Microsoft if they find the company abused its dominance, or even tell it to make compromises like opening the source code for Windows - making staying in the market unappealing. Giving up on China may not yet be in the plans, but it’s increasingly unclear whether staying is making much difference.