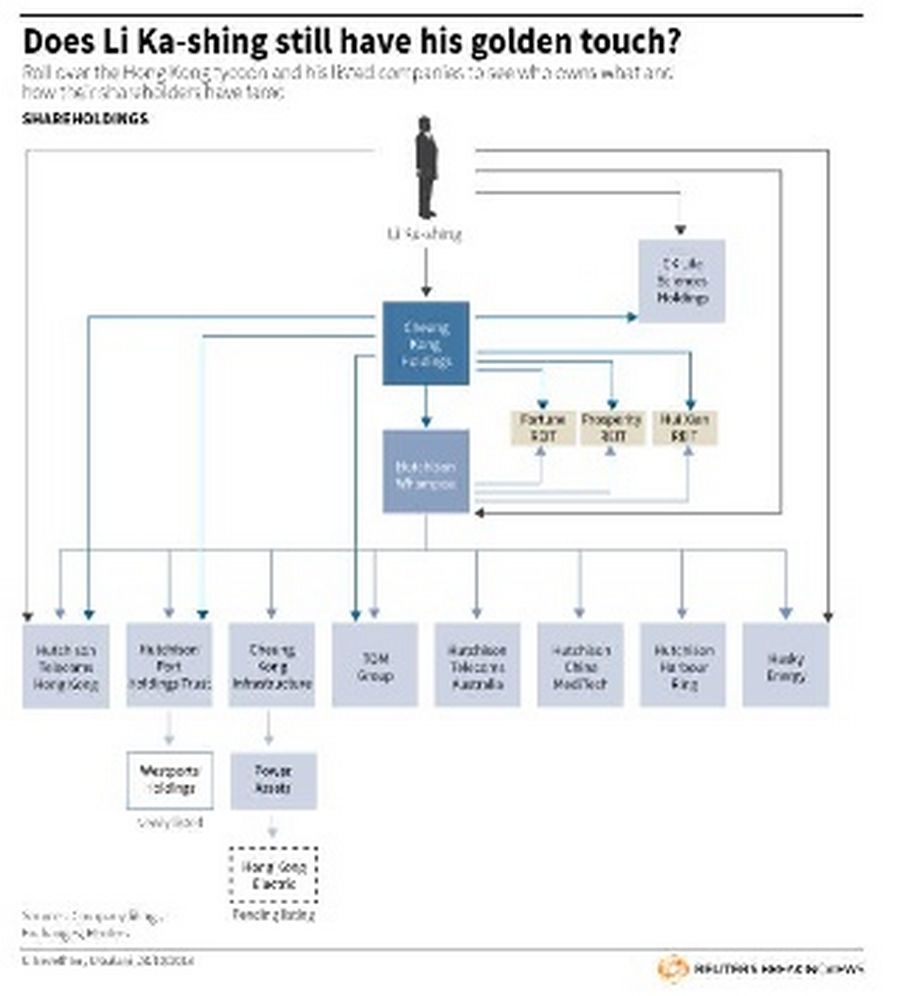

Li Ka-shing may be an octogenarian but he still knows when to buy and sell. An analysis of 16 listed parts of the Hong Kong tycoon’s telecoms-to-energy empire, with a combined market capitalization of more than $170 billion, shows a mixed record of delivering shareholder returns. Yet Li’s flagship holding companies have matched or beaten the market over the past two and five years. For investors, it pays to invest as close as possible to the man himself.

Start at the top of the chain. Total shareholder returns from Cheung Kong Holdings, in which Li directly owns a 43 percent stake, and Hutchison Whampoa have outpaced those of the Hang Seng Index by as much as 3 percentage points over the past two years, and 5 percentage points over five years, according to Datastream. That’s despite a substantial discount to the sum of their parts that dates back to when Li began to invest in 3G technology in 2000. Both companies trade around one-third below their net asset value, according to brokerage CLSA.

Look further down the chain and returns are more mixed. The worst-performing bits of Li’s empire have been Hutchison Whampoa’s telecom business in Hong Kong and Hong Kong-listed property investment vehicle Hutchison Harbour Ring. The best have been some of Li’s real estate investment trusts, owned partly by Cheung Kong Holdings and Hutchison Whampoa. Cheung Kong Holdings’ local subsidiary CK Life Sciences has also delivered outsized returns.

Li’s latest cash-raising manoeuvres will add complexity. The upcoming listing of Hong Kong Electric, which could be accompanied by raising debt, could release as much as $8 billion for acquisitions, according to one banker close to the deal. After failing to sell supermarket chain ParknShop, Hutchison may now float all or part of its wider retail assets with a likely market value north of $20 billion. Where those funds will go remains a mystery.

The challenge of delivering high shareholder returns is growing with the number of cash-flush buyers in Asia. While Li made his fortune in Hong Kong, his investments are increasingly focused on other markets. But the outperformance of the companies that sit closest to Li shows that the Hong Kong tycoon remains a shrewd manager, at least when his own money is on the line.