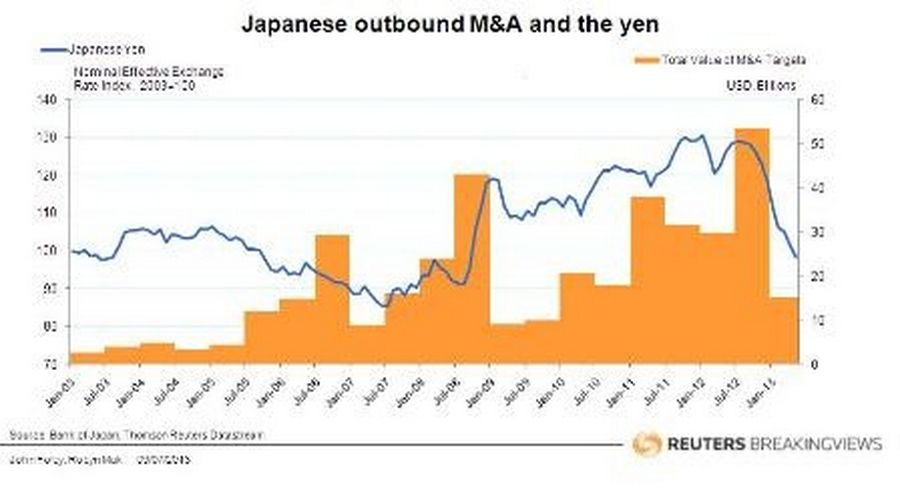

Shinzo Abe may yet revive Japan’s economy, but so far he has done the opposite for the country’s chief executives. The volume of overseas mergers this year has been positively lethargic. The prime minister’s efforts to cheapen the yen, and volatile markets, partly explain the lull, but the case for going abroad remains strong.

The $15.1 billion in outbound deals announced in the first six months of 2013 was Japan’s weakest effort since the second half of 2009. Worse, half of the year’s mergers to date came from just three deals, by financial giants Sumitomo Mitsui, Mitsubishi UFJ and Dai-ichi. It’s a far cry from last year’s $83 billion haul, which was crowned with SoftBank’s $20 billion bid for U.S. telecom Sprint.

A falling yen can’t take all the blame, but it will have damped spirits. Take SoftBank’s bid. Converted into the buyer’s own currency, the sticker price has risen 29 percent since it was announced in October, two months before Abe took charge. Of course, Sprint’s U.S. dollar cash flows are worth more too. But were the yen to strengthen again, today’s buyer would get the worst of both worlds when converting future flows back into home currency.

Volatility is a more real impediment, since it affects companies’ financing as well as their confidence. Futures contracts on Japanese government bonds turned exceptionally jumpy in the second quarter of 2013, as Abe’s government strove to chivvy up inflation. That will have pushed up the price of currency hedges, which buyers often use to insure themselves until announced deals complete.

Finally there’s volatility of a political kind. Japan is holding elections for its upper legislative house on July 21. After that, Abe will probably have greater elbow room to push through his pro-growth policies. Some of them — such as proposed tax incentives that encourage more capital spending — may make overseas purchases relatively less attractive.

None of these should hold CEOs back for long. A shrinking, ageing population makes Japan’s consumer demographics unattractive. The country is short of energy commodities, and manufacturers still face pressures to lower their costs by shifting operations overseas. Once volatility eases up, Samurai spirits should return.