Skittish markets are a threat to Japan’s anti-deflation drive. The rising yen, falling stocks and lower government bond yields suggest investors once again view Japan as a safe haven. The Bank of Japan may need to be bolder to prevent their expectations from becoming self-fulfilling.

Investors’ euphoria about Abenomics has turned to gloom. On June 13, the Nikkei share average slumped 6.4 percent, falling to a level not seen since BOJ promised to double the monetary base on April 4. The yen, trading at 103 to the dollar less than a month ago, is now at 94. Yields on 10-year government bonds remain low at 0.86 percent. All three are signs that investors are again seeking cover in Japanese government debt amid uncertainty over when the U.S. Federal Reserve will unwind its stimulus.

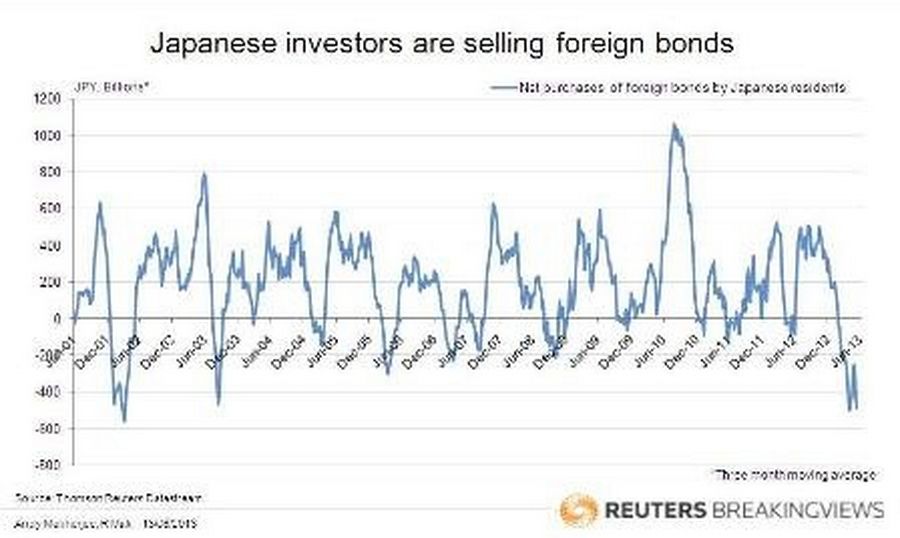

The only reason Japanese investors might want to buy low-yielding JGBs is if they expect the economy to remain mired in deflation. If they believed the BOJ’s forecast that inflation will be 2 percent by 2015, they would not be selling foreign bonds and repatriating money home, which is what they have done since February. Initially, some of the cash may have been lured by the surge in the stock market. Now that the equity rally has faded, the worry is investors are once again parking cash in JGBs.

Such market movements can become self-fulfilling. Rising stock prices helped to stimulate spending in Japan by making consumers feel better off. Similarly, capital inflows into Japan could push up the yen, stamping out the nascent revival in exporters’ optimism. Without new investment, job creation and wage and credit growth, Prime Minister Shinzo Abe’s election promise of 2 percent inflation will be hard to achieve.

The BOJ may argue that the blame for the jitters lies with the U.S. Federal Reserve: other Asian markets have also dropped in recent weeks. Nevertheless, it may need to act more boldly. One possibility would be for the BOJ to revive its idea of buying foreign securities with newly printed yen. Not only would such a move weaken the Japanese currency, it will also keep a lid on U.S. Treasury yields. Investors would breathe a sigh of relief.