The recent spike in Japan’s bond yields is not a canary in the country’s debt mine. Though the yield on 10-year government bonds has almost doubled since the Bank of Japan announced its aggressive money-printing pledge on April 4, it’s still less than 0.9 percent. Before the 2008 financial crisis, yields were twice as high.

Falling bond prices do not reflect concern about Japan’s government debt load, which stands at 237 percent of GDP. Though spreads on credit default swaps linked to sovereign debt have crept up in recent days, they are still lower than in early April. Equity investors are equally untroubled: Thomson Reuters’ Japan Banks Index is up 22 percent since the end of March.

A more plausible explanation is that rising inflation expectations are prompting households to move some money out of low-yielding bonds into more attractive alternatives, like the stock market. The worry is that rising yields will push up Japan’s borrowing costs, eventually causing the country’s debt to spiral out of control.

However, the portfolio churn won’t turn into a rout. For one, additional government borrowing of 80 trillion yen ($780 billion) this year and next can be financed out of the extra savings that will result from Japan’s economic revival.

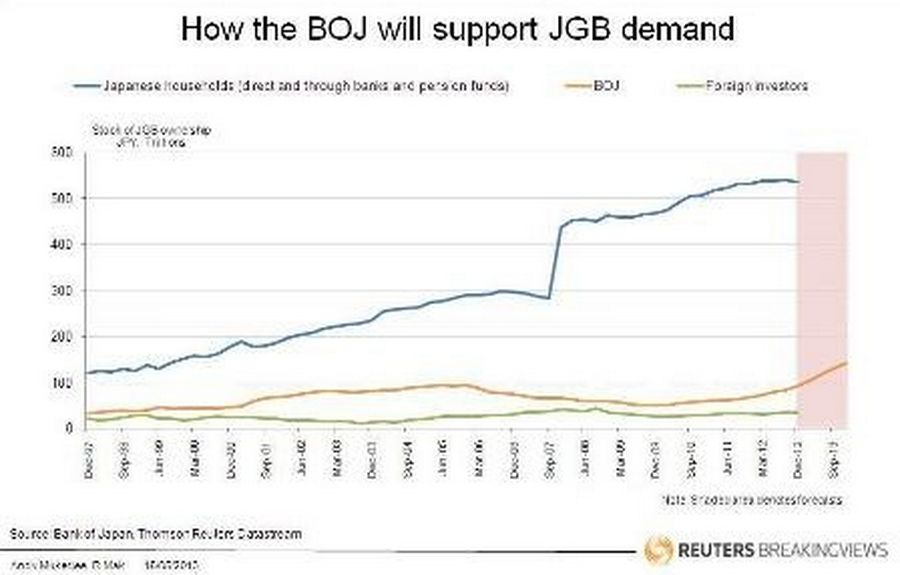

More importantly, the BOJ has promised to double its holdings of JGBs to 190 trillion yen over two years to the end of 2014. Assume that foreign investors, who currently own JGBs worth 35 trillion yen, cut their holdings in half over the same period, replicating their selloff between 1998 and 2003.

That leaves the nation’s fabled Mrs. Watanabes - the domestic investors who control 500 trillion yen of government debt directly, or through banks, insurers and pension funds. In order to tilt the market in favour of sellers, those investors would have to slash their holdings by one-sixth, or 90 trillion yen, in two years.

Such a large portfolio shift would be highly out of character. In the 12 months up to September 2007, when Japanese investors were chasing risky assets in a much more carefree world than today, Japanese households pruned their JGB holdings by just 14 trillion yen.

Despite the gains of recent days, shorting JGBs looks set to remain the “widowmakers’ trade” that it has been over the past decade.