A weaker yen won’t reverse Japan Inc’s overseas M&A drive. While a strong currency, low interest rates and a stagnant home market fuelled an international shopping spree in 2012, the promise of a domestic revival under new Prime Minister Shinzo Abe has caused buyers to temporarily put away their wallets. But even so-called Abenomics can’t cure Japan’s ageing and shrinking population.

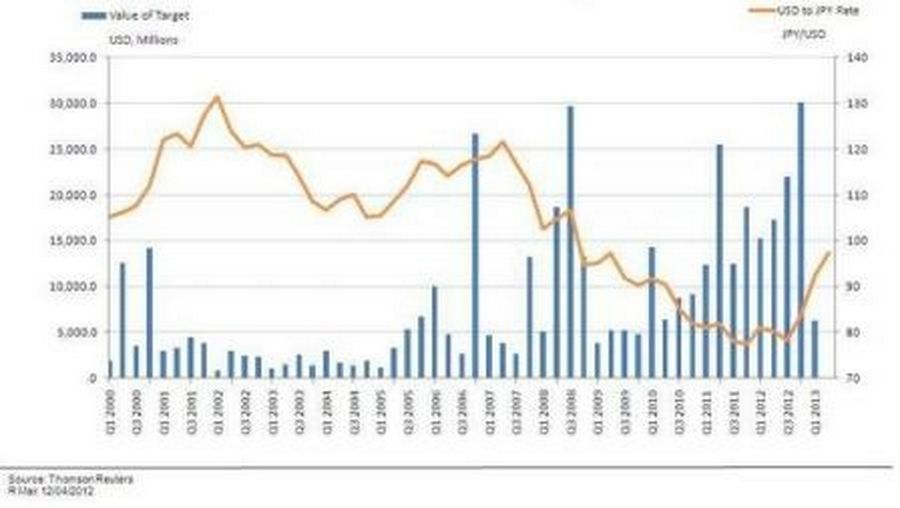

Last year marked a high point for globetrotting Japanese merger advisors. Deals like Softbank’s audacious $20 billion takeover of U.S. mobile operator Sprint - now facing a counterbid from pay TV operator Dish Network - lifted overseas purchase activity to a record $84.6 billion. With Japan stuck in a deflationary slump and the strong yen hollowing out the country’s manufacturing base, a growing number of companies chose to gamble on foreign expansion.

Abe’s arrival has temporarily slowed the exodus. The prime minister’s policy of central bank money-printing, fiscal stimulus and structural reform may have prompted some companies to revisit their plans. The yen’s slide hasn’t helped: it has dropped roughly 15 percent against the dollar since Abe was elected, crimping Japanese companies’ spending power. In the first quarter, they discharged just $6.2 billion on foreign acquisitions, down from $15.3 billion in the same period of 2012.

Yet there are good reasons to believe the foreign investment drive will continue. First off, the yen isn’t that weak. Six years ago, it was 20 percent lower. Japan’s buoyant stock market - the Nikkei 225 index is up 37 percent since mid-December - has boosted confidence and may allow companies to finance deals with equity as well as debt. Besides, a bit more inflation won’t reverse Japan’s demographic decline. Companies that rely on selling more stuff to consumers will have to look towards other markets.

Hopes of a revival of foreign interest in Japanese companies also look premature. Some troubled industries will find it harder to retain non-core businesses: ailing electronics group Panasonic, for example, is considering a sale of its healthcare operations. Western private equity groups are also increasingly active in Japan. But foreign companies hoping to buy in Japan still face formidable cultural and regulatory hurdles. Whether or not Abe’s policies are a success, the balance of Japanese M&A will remain overwhelmingly outward bound.