Japanese workers are hoping for a 1980s revival. If the Bank of Japan’s 2 percent inflation goal appears daunting, meeting it in two years - as promised by new chief Haruhiko Kuroda - is even more of a challenge. For the central bank to succeed, wages will have to grow faster than they have in the past two decades.

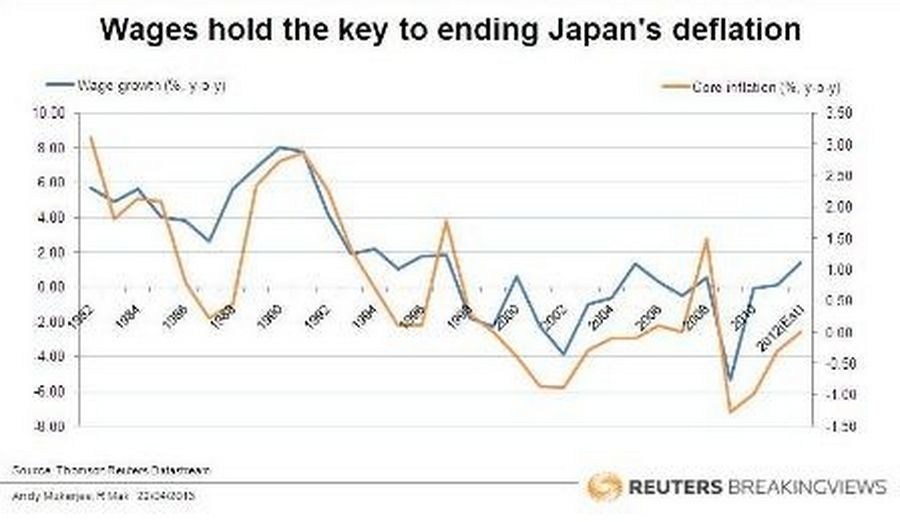

The past relationship between inflation and wages in Japan has been remarkably tight. In order for prices to rise at a 2 percent annual pace, workers’ pay will need to expand by about 5 percent a year, Breakingviews calculations show.

It’s been a long time since Japanese workers enjoyed such a bonanza. Total wage income has declined 15 percent since 1997 as baby boomers have retired without sufficient younger workers to replace them. This has led to a downward spiral where consumer prices fall in tandem with declining incomes, while falling prices crimp employees’ wage-bargaining power.

But a shrinking workforce may now help. Japan’s shallow pool of potential jobseekers means that if the BOJ’s policies unleash new investment, the unemployment rate could slide quickly. For 5 percent wage growth, the jobless rate will need to fall to below 2.7 percent, from 4.3 percent at present, according to UBS economist Daiju Aoki.

But why would Japanese companies, which do not fire employees in bad times, hire more of them in good times? One reason is that the labour market is getting tighter. The ratio of job advertisements to applicants is higher now than its three-decade average, and for the first time since the 2008 financial crisis, more companies reported a shortage of workers than an excess in the first quarter of this year.

The 20 percent slide in the yen against the US dollar since last November will also allow Japanese exporters to raise pay without sacrificing margins. By contrast, however, importers will face pressure on earnings. Only 8 percent of companies responding to a recent poll by Reuters said they were considering lifting wages as a result of the weaker yen.

That should worry the BOJ. If wages take time to recover, Kuroda’s promise of 2 percent inflation in two years may go unfulfilled, and the central bank’s credibility will take a knock.