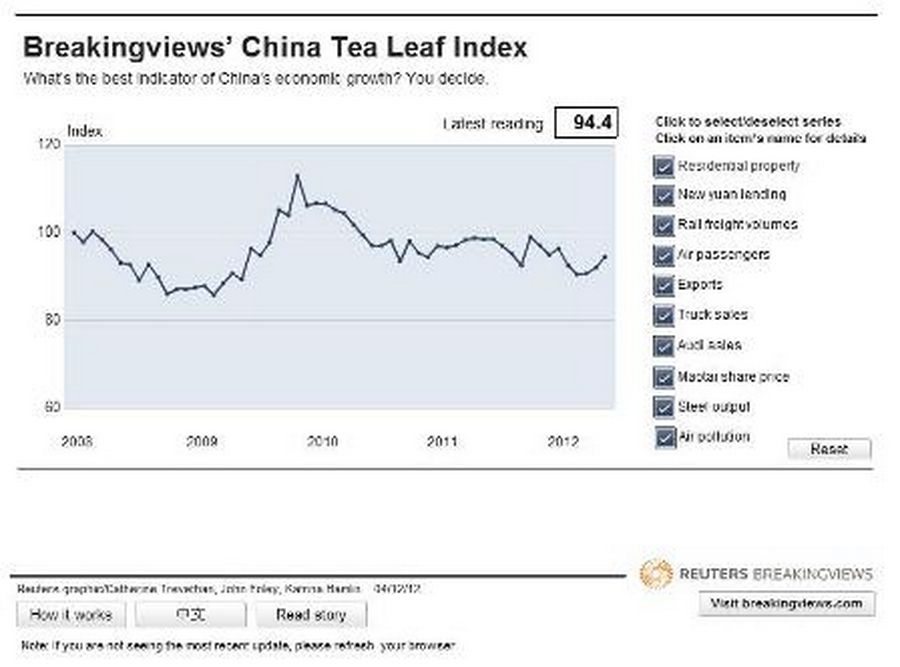

China’s economic recovery is a tale of three engines. The Breakingviews China Tea Leaf Index confirms that on the face of it, the economy is regaining traction, delivering a latest reading of 95 compared with the previous month’s 91.9. But not all growth is equally good, and not all of the moving parts are running as they should.

Source: Reuters graphic/Catherine Trevethan, John Foley, Katrina Hamlin 04/12/12

Tea Leaf Index Nov 2012 SMALL

First, there are the old metaphorical engines of China’s growth. Residential property investment and steel production have both recovered from worrying lows. That shows developers and mills getting credit again - though not from the usual bank sources. For the first time in three years, off-balance sheet financing like trust loans, “entrusted” loans and bonds added more juice to the economy than straight bank lending.

Then there are motors of a literal kind. Audi unit sales expanded at an annual rate of 30 percent in October. It’s estimated that a fifth of Audis go to government buyers, which might explain why Audi’s average monthly growth since 2009 has been five times the growth of the overall passenger car market. China’s new leaders vowed on Dec. 4 to curb official excess, entourages and ribbon-cutting. But for now, Audi’s run suggests life in the public sector remains sweet.

Finally, there are the engines that run on rails. Train-borne freight, a good insight into the level of goods and parts being transported around the country, dropped for the fifth month running. That bodes ill for manufacturing businesses. It’s also worrying for employment, one of the indicators factored into the China official PMI survey, which just came in at its lowest level, bar one month, since February 2009. China is picking up speed, but not all are able to enjoy the ride.